Rs.3899 All inclusive price

Income tax return filing for persons having DIN or owing private limited company shares.

Rs.3899 All inclusive price

Income tax return filing for persons having capital gains.

Rs.5899 All inclusive price

Income tax return filing for persons having foreign assets or foreign income.

- Basic

-

Rs.3899 All inclusive price

Income tax return filing for persons having DIN or owing private limited company shares.

- Standard

-

Rs.3899 All inclusive price

Income tax return filing for persons having capital gains.

- Premium

-

Rs.5899 All inclusive price

Income tax return filing for persons having foreign assets or foreign income.

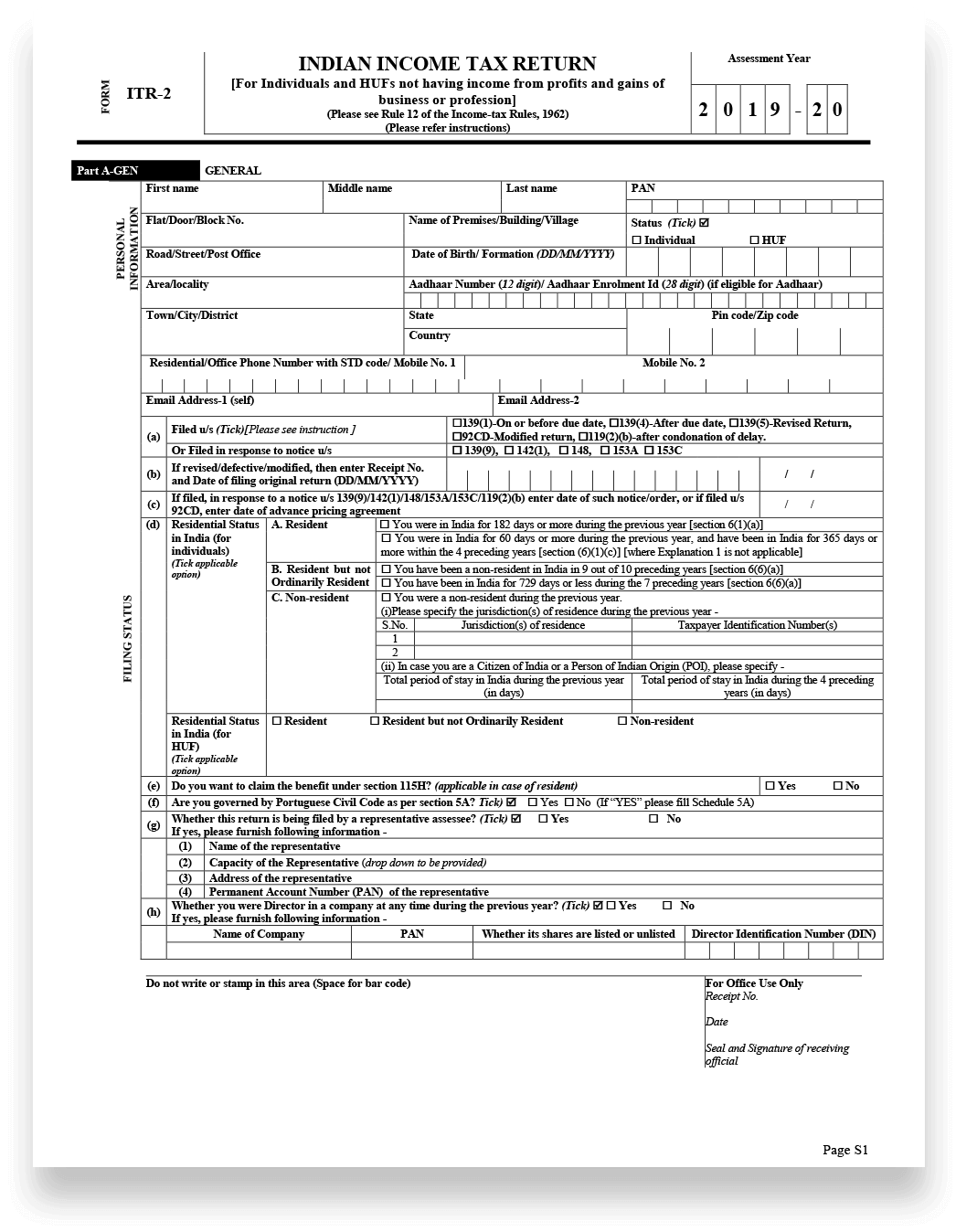

ITR-2 Form Filing – Income Tax Return

The ITR-2 Form is an important Income Tax Return form used by Indian citizens, as well as Non Resident Indians to file their Tax Returns with the Income Tax Department of India. Individuals who are not eligible to use ITR-1 can use the ITR-2 Form.

Individuals and Hindu Undivided Families who have their Income for the Financial Year through Salary or Pension, more than House Property, Income from Capital Gains, Income from foreign assets/Income, Income from business or profession as a partner (not proprietor) and other sources including lottery, racehorses, legal gambling are eligible to file their IT Return using ITR-2. Individuals who are not eligible to file using ITR-1, because of their income exceeding ₹ 50 Lakhs, also need to file using ITR-2.

Pay as you go grow pricing

All Inclusive Pricing – No Hidden Fee

Basic

Income tax return filing for persons having DIN or owing private limited company shares.

Standard

Income tax return filing for persons having capital gains.

Premium

Income tax return filing for persons having foreign assets or foreign income.

ITR-2 form can be filed under three methods:

- Filing ITR-2 form using digital signature certificate.

- Transmitting the data in ITR-2 form electronically under electronic verification code.

- By transmitting the data in ITR-2 form electronically and then mailing (By post) the return in Return Form ITR-V to the Income Tax Office.

Assessee filing ITR-2 form under the third method must complete the acknowledgement in ITR-V. After preparing ITR-V, the assessee should print out two copies of Form ITR-V. One copy of ITR-V, duly signed by the assessee, has to be sent by ordinary post to

Post Bag No. 1,Electronic City Office,

Bengaluru— 560 100,

Karnataka.

The other copy may be retained by the assessee for his record.